Introduction

Looks like banks were waiting for an opportunity of this sort to come by. The good part is that even state run banks in developing economies, with their cobwebbed style of functioning are enticed to pull this rabbit out of their hats. What are we talking about? It’s Mobile banking!

How about empowering yourself with banking on your palms? Read this article to let you know how.

How banking became mobile

Prior to embracing mobility, banks had invested hugely into computerizing their infrastructure, in tune with times. The arrival of internet prompted banks to set up websites and offer some over-the-counter services like account balance enquiry, cheque requests, money deposit status, enhancements to account and so on. Banks were keeping their customers informed via the Short Messaging Service utility in mobiles. Notifications of money in their account or transaction alerts were communicated via SMS. These do exist even now. All that the customer had to do was register his/her mobile phone number with the bank. After completing a few verification steps, the customer was brought into the bank’s information service system.

But the customer yearned to do more than just receive alerts. Questions, provoking capability like “I want to transfer money to a friend’s account but I’m stuck in this highway “, “I want to check my tax credits,”, “I want to pay my utility bills” and such umpteen questions made their way into the strategy rooms of banks. Given the stiff competition in today’s financial services industry, banks were looking for ways to extend their web based services to other, perhaps nimble domains. The introduction of wireless application protocol for mobile web aptly enabled banks to steamroll services into mobiles, thus heralding the era of banking mobile apps.

Why are Software Companies Salivating?

Banking and insurance constitute the largest chunk of any software developing company’s revenues. They had already developed the web versions for services which were well received. Now the prospects of turning these services into mobile format meant another huge opportunity.

But all of them cannot replicate the web model to mobile platform as it is a different ball game. That is why banks started courting niche mobile application development companies developing dedicated banking apps. App developers in these firms use the mobile enterprise application platform to develop apps offering a familiar feel of the interface and ease of navigation to the customers.

Banking via mobile has brought about empowerment to even the rural populace that can afford a mobile. Customers can check their account balance, transfer funds, place requests for services, halt fraudulent transactions, view tax credits and so on, while being mobile. Mobility companies indulge in the following mobile banking app developments:

- · Android application development

- · Windows phone application development

- · iPhone application development

- · iPad application development

- · Blackberry application development

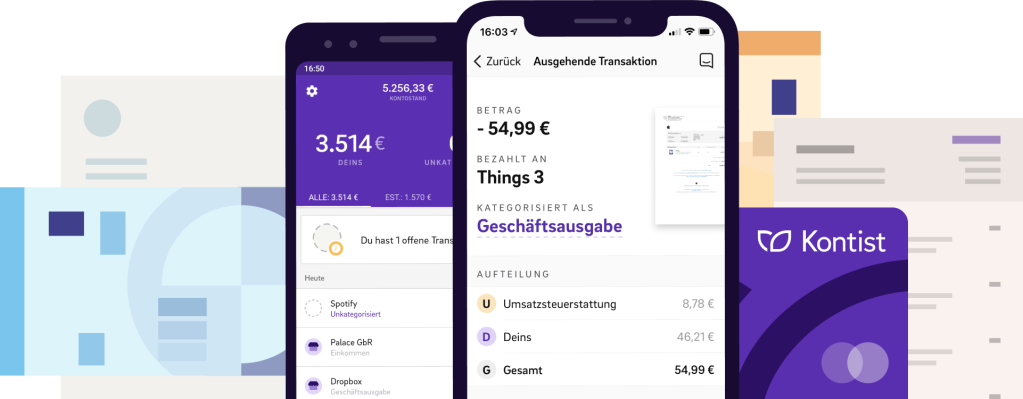

These platforms provide scalable opportunities to develop and enhance banking related products such as Kontist and the kontist mastercard.

What is the future of mobile banking?

Banking is set to undergo further changes in the coming years. Tablets and phablets, also mobile devices, offer another opportunity to develop customized banking apps because of their larger screen size and navigation patterns. The features and safety offered are expected to increase, requiring rework of architecture to keep the app light, robust and fast.